FinPro Member Update – April 2020

April 30, 2020

Presidents Message

Another week has flown by and I’m sure that like me, you are swamped with emails, ZOOM meetings and working through scenarios of how the next weeks and months look for you both professionally and personally.

We are working hard behind the scenes to find out as much information as possible and share this with all our members in a timely manner. I’m sure you are looking for direction and advice on several items – and we hope to be able to assist to bring this clarity over the coming weeks.

LGV have advised us of the following late yesterday:

“LGV has advised that they are very aware of the range of concerns that have been expressed by FinPro and other stakeholders. We are working to provide a resolution to the key issues as soon as possible.

LGV look forward to advising of solutions that address the interest and concerns of Councils and our communities in the very near future.”

Thank you to Councils that were able to provide a response to our quick survey earlier in the week. The below just provides a quick (and non-scientific) snapshot of what Councils are currently considering.

- 37 individual Councils provided responses. 16 rural, 9 regional and 12 metro Councils.

- 86% were planning on continue with timing of the 4th instalment, with 14% offering a deferment.

- 70% were planning on rates for 2020/21 to be per the rate cap. 16% were planning for a 0.0% increase and 14% plan to raise per the rate cap but offer a rebate.

- 56% were expecting their waste charge to increase between 0-5%, 27% between 5-10% and 17% over 10%.

- We were provided with a wide range of topics for continued advocacy from FinPro, which the Executive will review.

Most pleasing for FinPro this week was that we were able to deliver our first ‘Looking after Yourself’ Webinar Series with Wayne Schwass. We have received some fantastic comments from members that were able to watch live or on record. We will continue these over the coming weeks and hope that you find them valuable and useful.

Look after yourself! Bradley

Membership News

We welcome the following new member this month to FinPro:

- Chris Parham, Corporate General Manager – Mildura Rural City Council

- Tammy Smith, Director Business Strategy and Performance, Yarriambiack Shire Council

- Adam Black, Team Leader Revenue & collection, Kingston City Council

If you have any news to share with the FinPro membership please forward this to Gab.

Upcoming FinPro Events – Dates for your diary

“Looking after yourself” Webinar Series run by Wayne Schwass

Held online each Wednesday at 1pm and also available as a recording

FinPro Seminar – Friday 29 May 2020

TBA – we will run something via the web.

FinPro Conference – Wednesday 21 – Friday 23 October 2020

RACV Cape Schanck

FinPro Technical Committee News / Update

Update from LGV

Paul Roche from LGV has provided the following update for members: “LGV has advised that they are very aware of the range of concerns that have been expressed by FinPro and other stake holders and they are working to provide a resolution to the key issues as soon as possible.

LGV look forward to advising of solutions that address the interest and concerns of Councils and our communities in the very near future.”

FinPro will continue to be in contact with LGV to further discussions around the issues raised in our letter to them last week covering the following:

- Council Meetings

- Council Budget 2020/21

- Rates and Charges 2020/21

- Local Government Rating System Review

- Rates Deferral

- Landfill Levy Increase

- Financial Relief / Economic Stimulus packages

Update from VAGO

We acknowledge the importance for councils to focus on delivery of core services in response to the COVID 19 event that is unfolding. Our systems and processes are well set up to conduct audits remotely allowing for the continuation of our audit services while minimising our impact on your operations. If councils have the capacity to deliver on the audit program, we can work flexibly with you to get the best outcome.

Changes to financial audit arrangements to ensure employee welfare:

The health and welfare of your and our staff are paramount, especially under the present circumstances. To minimise the health risks and to cater for new working arrangements, we have implemented our remote audit protocol. Details:

- Our office is closed to all visitors and staff from 27 March 2020

- VAGO staff are not allowed to visit client sites and hold face to face meetings without prior approval the Auditor-General or Deputy Auditor-General

- We are using technology to enable virtual meetings

- We will continue to use of our secure electronic document system to transmit and receive all audit documents

Audit Service providers (‘ASP’):

We are in regular contact with our ASP firms regarding potential impact of the COVID 19 event on the delivery of audits, financial reporting requirements and other general matters. They advise us that they are also adopting similar remote auditing protocols.

Other updates:

- Roberta Skliros started her role as Assistant Auditor General, Financial Audit from 1 April

- Jung Yau started as a manager with Local Government team from 24 February.

- Anh Ha was successful in securing a two-year secondment to the VAGO finance team as CFO and will transition on 4 May. We are in the process of backfilling that role.

- We are finalising audit fee letters for 2019-20 audit cycle. Recent unforeseen events have slightly delayed this process.

- We are assessing COVID 19 risk from a financial report and performance statement perspective and formulating responses for 2019-20 audits.

We are in contact with Local Government Victoria to understand their current thinking on potential alternatives to financial reporting requirements and timelines, dependent on the varying scenarios likely from COVID-19 event. We will continue to keep the sector updated on any changes that may impact financial reporting and /or audit delivery.

Please feel free to contact me (Sanchu Chummar, Acting Sector Director on 0472 838 905 or [email protected]) if you have any questions.

Stay safe and well.

Proposed Local Government Act 2020 – Update

The Local Government Act 2020 has now received Royal Assent and information is available at www.localgovernment.vic.gov.au. This website is the centralised point of information. The website will have links to:

- Important dates;

- Guidance material; and

- Engagement opportunities.

Federal Government Economic Stimulus Package – Job Keeper Allowance

The MAV are seeking clarification through ALGA about whether councils will be eligible under the Job-Keeper Allowance program announced by the Prime Minister. While it is possible councils may not be eligible, legislation is still being drafted and ALGA is seeking to work with a range of Ministers’ offices and the Opposition to advocate for councils to be eligible. We will update you once we have more information.

FinPro Resource Library

FinPro would like to share information and resources that make life ‘easier’ for Finance Staff. As such, the following information is provided as a resource to FinPro members.

- COVID-19 Financial Hardship Policy – Example from Moreland CC March 2020

- Sample of email to supplier re COVID – Bayside CC

- Flexible Work Arrangement Guidelines – updated March 2020 (Maribyrnong CC)

- Procedure – Office Ergonomics – 2018 – (Maribyrnong City Council)

- COVID 19 – Council Support Options (Port Phillip City Council) March 2020 and also COVID 19 – Council Support Options (attachment) Port Phillip City Council) March 2020

- COVID-19 Financial Hardship Guidelines – DRAFT – City of Greater Bendigo March 2020

- Loan Equipment Form – Indigo Shire – March 2020

- Working from home checklist – Indigo Shire – March 2020

- Info to Contractor re COVID-19 – Indigo Shire – March 2020

- Zoom User Guide – Prepared by the City of Great Bendigo March 2020

Thank-you to all who have shared their documents. If you have any other documents to share please send them through to gab.

Accounting Standards Guidance

A reminder that a working group comprising FinPro Members, Staff from LGV and Crowe prepared a comprehensive guide with examples applicable to Local Government last year. Much of this comes into practice on 1 July – it may be useful to refer to the guidance material included on our website.

FinPro Professional Development Committee News / Update

Looking after yourself’ Webinar Series

Life as we know it has changed for all of us. We can’t control this, but we can control how we react and manage in these changed conditions. It is for this reason that we have decided to run a free weekly webinar series for all our members. On Wednesday 1 April 2020 we started a webinar series which is available to all our FinPro members, either online at 1pm (for up to 100 members) or via the recording that will posted on our website following the online session.

In webinar 1, Wayne set the scene and focused on the feeling we all have right now of ‘overwhelm’. link to the webinar

In regards to the webinar – Sharon Morrison, Director Corporate Services, Loddon SC said:

“One of the more down to earth, practical and engaging webinars I have seen in this climate. I will definitely tune in next time or watch afterwards if the timeslot goes crazy!”

And Karen Milner, Acting Manager Financial Services said:

“Thank you for organising this, it was brilliant and just what I needed this week I think!”

Wayne also has a podcast series which is available to listen to. For those who enjoy a podcast, this may be a useful tool to include in your weekly program. access the podcast series

It’s a great free resource where Wayne interviewed people about how they have managed the mental health and wellbeing. We hope it might give you some ideas about what you can do. In series 2 he will interview people in particular fields (meditation, mindfulness, stress etc.).

Messages from our Supporters and Partners

Message from NAB

All NAB customers are now eligible to access wellbeing support through NAB’s Employee Assistance Program. The service gives customers access to independent, professional counselling sessions for support in managing challenging life circumstances. The service is provided by Benestar, and is completely confidential and free of charge. Counsellors are available for face to face sessions in most regional centres. Where this is not possible, telephone sessions can be arranged.

Any enquiries can be directed to myself.

Please take care and stay safe.

Cecilia Ho

Associate Director

Nab Government, Education and Community Business

[email protected]

Vision Super’s response to COVID-19

Even during this time of uncertainty, one thing remains the same: Vision Super is committed to providing support to our members and employers.

Although we’ve had to make changes to how we service our members (the Vision Super office is closed and we can’t provide face-to-face support, like seminars) we continue to help our members over the phone and via email, as well as responding to any queries that come through our social media channels.

Of course, members can still log in to their account on our website, and download the Vision Super App from the App store or Google Play. It’s a great way to check, manage and make changes to your super – like letting us know which is the best channel to communicate with you. So, if you haven’t already you may want to think about updating your communication preferences to digital and getting your super updates faster, by email and/or SMS.

We’re also providing regular updates via the Vision Super website. On the website, you’ll be able to find out more about investments, market performance and the Federal government’s superannuation initiatives.

Please, don’t forget though that super is a long-term investment. Even if you’re coming up to retirement age or retired, your money may still need to be invested for another 20 or more years. We understand that one of the main reasons people switch to a more conservative option is in response to market volatility, thinking they will avoid further losses. But by doing this, they may be locking in losses and could potentially miss out on higher

returns when markets do recover. So, before making any changes to your investment strategy, you should think about your personal objectives, situation and needs.

If you’re after help understanding the right investment option for you, you can discuss your personal risk profile with a financial adviser. They will be able to recommend the option that’s best suited for your personal circumstances. To book an appointment with a Vision Super financial planner, complete the online form to arrange an appointment. Advice on certain single superannuation issues like your investment option can usually be provided at no cost to you, over the phone or via video conference.

Finally, we would like to thank you for your continued support and understanding as we all manage these challenging times together.

Vision Super

Visit: visionsuper.com.au

Call: 1300 300 820 Monday to Friday 8:30am to 5 pm

Email: [email protected]

Vision Super – 26 March Update

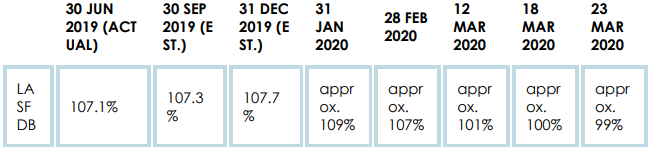

Local Authorities Superannuation Fund Defined Benefit Plan (LASF DB) – Vested Benefit Index (VBI) update (COVID-19 #3)

Since our last update (distributed on 20 March 2020), the global responses to COVID-19 have continued to significantly impact investment markets.

For the period between 18 – 23 March 2020, it is estimated that LASF DB’s VBI has dropped approximately 1%, as shown below:

As previously indicated, the drop in the LASF DB VBI has been softened primarily due to:

- Strategic exposure to equities of 44.5% and actual exposure of 36% in mid-March 2020. This allows for offsetting returns from other asset classes including bonds, infrastructure and cash, and

- Payoff returns from the implementation of the tail risk hedge insurance. This hedge has contributed $65m or approximately 3% to the sub-plan which has helped to partly offset equity market falls to 24 March 2020. This gain has been wholly reinvested for the back into sub-plan, into cash. As of 24 March 2020, the tail risk hedge was fully realised and will not provide any further cover.

What if the VBI drops below the shortfall limit?

Under the superannuation prudential standards, no specific action is required when the VBI is above the fund’s nominated shortfall threshold of 97% (or 100% during an actuarial investigation). Where the VBI falls below the relevant threshold, a restoration plan is required to restore VBI to 100% within 3 years.

As previously advised, in the event the VBI falls below the nominated shortfall threshold (ie: 97%), an interim investigation is required to be carried out by the Fund Actuary, unless the next scheduled investigation is due within six months. If the VBI falls below 97% prior to 30 June 2020, LASF DB sub-plan’s next scheduled investigation as at 30 June 2020 will satisfy this requirement. This actuarial investigation will be completed by 31 December 2020.

If it is likely that the 30 June 2020 VBI will be less than 100%, the Trustee will develop a proposed restoration plan in consultation with the Fund Actuary, sponsoring authorities/employers, APRA and other relevant bodies. The restoration plan may include any or a combination of the following:

- Keeping a watching brief on investment market movements

- Higher regular contributions, and/or

- A funding call if necessary, within the three years

The Fund Actuary will review the proposed restoration plan and, if appropriate, recommend that proposed restoration plan be adopted.

Will there be a funding call?

Funding calls are just one option that may be included in a restoration plan. Depending on the size of the funding deficit/unfunded liability, there are a number of ways for the DB subplan to be returned to a satisfactory position and there are no prescribed options to be included as part of a restoration plan.

If Vision Super is required to establish a restoration plan, the final restoration plan must be approved within 3 months of the Trustee receiving the Fund Actuary’s report which includes the Fund Actuary’s recommended restoration plan. If LASF DB sub-plan’s 30 June 2020 VBI is less than 100%, the Fund Actuary’s report will be received by 31 December 2020. Assuming that the report is received on 31 December 2020, the Trustee must adopt the final restoration plan by 31 March 2021.

We appreciate that, as employers, you would like as much advance notice of a funding call as possible to assist you with your own budgeting and planning. At this stage, it is too early to determine whether a restoration plan will be required and whether a funding call would form part of that restoration plan.

Vision Super will continue to monitor the sub-plan’s financial position. We note the next detailed estimation of the LASF DB VBI will be as at 31 March 2020. As indicated above, the next scheduled actuarial investigation is as at 30 June 2020. This is a triennial investigation and will be a comprehensive review of the sub-plan’s position.

For further information on the LASF DB sub-plan, please refer to the Defined Benefit Employer Booklet

Action required (if any)

At this stage, no action is required by you.

Sean Ellis, Vision Super

PD Hours

Wanting to update your CPD Hours Register for CPA Australia or AANZCA? For a list of all the professional development events held by FinPro since 2015 please refer to our website.

FinPro Yammer Forum

Never has it been more important than now to reach out to other FinPro Members and be a part of the FinPro Yammer Forum. This online discussion platform gives an opportunity for members to raise topics for discussion, ask questions, seek out policies and also find out what is going on in the sector.

If you are not already a member of the forum, please contact FinPro and we can join you up – email gab at [email protected]

If you are a member, we encourage you to get online and seek the assistance of your fellow LG Finance Peers.

Make sure you sign up to FinPro – Victorian Local Government Finance Professionals, on LinkedIn to stay in contact with current past members of FinPro.

Regional Finance Groups

Whilst FinPro offers training and networking opportunities for all finance professionals working in the Victorian Local Government sector, our regional groups also provide additional opportunities for training and networking. These are more informal sessions which really benefit from input and support from the Council’s in each area. Please get in touch if you think there are issues or opportunities which can be brough up at these groups.

There are 6 regional groups in Victoria, which together, cover all of the state. They are:

- Central Victoria – Contact: Nathan Morsillo, Greater Bendigo City Council

- South West Victoria – Contacts: John Brockway (Surf Coast Shire) and Belinda Johnson (Southern Grampians Shire)

- South East Victoria – Contact: Kim Jaensch, Frankston City Council

- Metropolitan – Contact: Tony Rocca, Maroondah City Council

- Western Metropolitan – Contact: Wei Chen, Wyndham City Council

- Northern Metropolitan – Contact: Tania O’Reilly, Banyule City Council

Each of these groups meets at least once per year as well as at the commencement of the FinPro Annual Conference, which this year, will be held at RACV Cape Schanck on Wednesday 21 October 2020.

Job Vacancies

FinPro is happy to place advertisements on our website for any finance related positions our members councils are advertising. To place details of any jobs on our website, please send the following details through to our Executive Officer, Gabrielle Gordon at [email protected]

- Job Title

- Website link

- Dot points giving main details of the position eg. salary or band and main details

- Contact person for any questions

- Closing Date

Currently we have the following positions advertised on our website www.finpro.org.au/jobs

- Project Accountant (Resource Recovery & Education) – City of Greater Bendigo -–

Position closes 6.4.20

FinPro / VAMA History

FinPro (formerly VAMA) has a long history of providing technical updates and networking opportunities for finance professionals working within the sector. Established over 30 years ago, the organisation has grown from a couple of finance managers sitting around a table sharing stories and information, to an organisation with over 550 members from all councils in Victoria.

Our plan over the next 12 months is to put together a history of our organisation. We are keen for any of our members who have any photos, stories or information they feel would be of value to share. If you have anything at all please contact Gab and let her know – [email protected] or 0400 114 015

FinPro Executive Members

President – Bradley Thomas (Hepburn Shire Council)

Executive Officer – Gab Gordon

Vice-President: Chair Technical Committee – Tony Rocca (Maroondah City Council)

Technical Committee members:

-

- Danny Wain (Monash City Council)

- Kristy Stephens (Bass Coast Shire)

- Liz Rowland (Moreland City Council)

- Mark Montague (Yarra City Council)

- Nathan Morsillo (Greater Bendigo City Council)

- Vishantri Perera (Yarra Ranges Shire Council)

Vice-President: Chair Professional Development committee – Binda Gokhale (Wyndham CC)

Professional Development Committee members:

-

- Belinda Johnson (Southern Grampians Shire)

- Charles Nganga (Casey City Council)

- John Brockway (Surf Coast Shire) – also leads the FinPro Mentoring Program

- Kim Jaensch (Frankston City Council) – also leads the FinPro Leadership Program

A little joke to share:

Thank-you to our 2019 Conference sponsors:

Platinum Sponsors – Commonwealth Bank

Gold Sponsors – LG Solutions

EFTSure

Silver Sponsors – BankWest

CT Management

Curve Securities

Genesis Accounting

Inlogik Pty Ltd

IT Vision

Laminar Capital

MAGIQ Software

Midstate CreditCollect

National Australia Bank

Recoveries & Reconstruction

TechnologyOne

Nelnet International

Westpac

Sector Partners: VAGO

LGV

Program Partner: Vision Super

Conference App Sponsor: Imperium Markets

Some of our wonderful sponsors have put together a case study showcasing what services or products they offer – to view these case studies just click on the sponsor as listed above!

Remember to turn back your Clock

Remember to turn back your Clock

5 Apr 2020 – Daylight Saving Time Ends

When local daylight time is about to reach Sunday, 5 April, 3:00am clocks are turned backward 1 hour to Sunday, 5 April, 2:00am local standard time instead. Sunrise and sunset will be about 1 hour earlier on 5 Apr 2020 than the day before. There will be more light in the morning.

To Contact FinPro:

Gabrielle Gordon

Executive Officer – FinPro

E: [email protected]

M: 0400 114 015

W: www.finpro.org.au