FinPro Member Update August 2020 (Edition 2)

August 31, 2020

President’s Message

Good afternoon,

I hope you are all travelling as well as you can be, and especially for all our Metro members,

making sure you get your 1-hour exercise and fresh air each day!

Today we held our August Executive Meeting and it was great to see everyone’s faces over

ZOOM. It certainly has been a busy last month for the sector and for everyone. We covered

a wide range of topics across both technical and professional development and you will see

more news today and over the coming weeks about this.

Today’s member announcement includes a letter that we have sent to the Victorian Ombudsman requesting an extension in time for prepare information for their investigation into rates hardship, as well as FinPro’s position on the upcoming Council elections.

The implementation of the Local Government Act 2020 continues full steam ahead, and in particular co-design work has started on the Integrated Strategic Planning and Reporting Framework. Next week FinPro will be calling for an expression of interest from members who would like to be part of a working group to assist us in the development of feedback and also the creation of documents to assist the sector.

Enjoy your weekend! It will be a great one as the Swannies have already won!

Bradley

Membership News

We welcome a number of new members this week:

- Ivan Dickinson has joined Yarra Ranges Shire as Assistant Accountant

- Jeremy Kerrisk has joined Bass Coast Shire as Systems Accountant

- Eleni Colasante has joined Mitchell Shire as Management Accountant

If you have any news to share with the FinPro membership please forward this to Gab.

FinPro Professional Development

Recordings of our recent sessions are available online:

LUNCH AND LEARN – Setting a New Work Mindset – 31 July 2020 WATCH NOW

FinPro Q&A – Technical discussion – 6 August 2020 WATCH NOW

The main discussion in the Technical Q&A was around preparation of annual accounts – some of the specific areas covered during the session were:

- Discussion around COVID-19 note disclosure

- Revenue standards changes

- AASB 15 / 1058 treatment of income

- Note 5.8

- Key Management Personal and SEO Remuneration

- Accounting relating to the implications of level-crossing removals

- Accounting for grants

- Recognition of volunteer (labour) Contributions

- Asset Valuations prepared pre-COVID

FinPro Technical Committee News / Updates

General Information

The LGV website provides a host of information: LGV – COVID19 Information

The FinPro Website provides a host of information: FinPro Resource Library

Caretake Period

Following conversations between LGV and ourselves, it is our view that it is generally acceptable for a council to consider (and certify) their annual report during the caretaker period.

As you know we’re currently in a transition period between the LG Act 1989 and the LG Act 2020 (as sections in the new act progressively commence and ones in the old act are progressively repealed). In relation to the caretaker period, the LG Act 2020 (s.69) provides that each council must

include an election period policy in its governance rules. Section 69(2) says:

- An election period policy must prohibit any Council decision during the election period for a general election that—

- relates to the appointment or remuneration of the Chief Executive Officer but not to the appointment or remuneration of an Acting Chief Executive Officer; or

- commits the Council to expenditure exceeding one per cent of the Council’s income from general rates, municipal charges and service rates and charges in the preceding financial year; or

- the Council considers could be reasonably deferred until the next Council is in place; or

- the Council considers should not be made during an election period.

- An election period policy must prohibit any Council decision during the election period for a general election or a by-election that would enable the use of Council’s resources in a way that is intended to influence, or is likely to influence, voting at the election.

So, unless a Council has a clause in its election period policy that bans the adoption of the annual report during that period (which would be unusual), it would be reasonable for a council to consider (and certify) their annual report during the caretaker period

Council Elections 2020

Current status is that Local Government elections continue to be scheduled for this year. You may have seen that LGV released some guidelines this week around how to campaign safely in a COVID environment, however the portal for mandatory candidate training has not yet been released (scheduled for early August). In line with this, we understand that LGV, the VEC and Councils are all planning for elections this year, however

the Minister Local Government is taking advice around the appropriateness of this. Our best advice to you at present is that you continue to plan for elections in 2020, but with a small eye to the media on announcements from the Minister.

We recently asked our members about whether they wished FinPro to take a position on whether we should advocate for the postponing of elections or not. Thank you to the many members who completed the quick survey. It gave us a fantastic insight into the mood of our membership. The results were evenly split with 52% of members supporting a 12-month deferment and 48% not in support. It is important to note that this data is reflective of our member feedback – official positions of Councils may therefore differ. General themes received from those who supported a deferment were due to the safety of being able to campaign in a COVID environment and the current workload demands in a pandemic situation. Those not supporting a deferment highlighted the important role democracy plays – all very valid pros and cons for the Minister to weigh up. Given our spilt in membership, FinPro won’t take a particular stance on this issue.

FinPro will however continue to advocate for appropriate support to be provided to the sector and if election dates were to change, that consideration be given to the timing of the implementation of the Local Government Act should this occur.

Information request from the Victorian Ombudsman

Councils recently received a request from the Victorian Ombudsman for information around responses to ratepayers in financial hardship. The FinPro Executive met earlier today and have prepared and sent a letter to the Victorian Ombudsman in response to this request – a copy follows:

Dear Ms Glass,

Investigation into council responses to ratepayers in financial hardship

We are aware of your letter dated 5 August 2020 to each Victorian Local Government Chief Executive Officer in relation to an Investigation into council responses to ratepayers in financial hardship.

Firstly, we do appreciate the opportunity for Councils to participate in the investigation in the key area of rate collection and we are sure that the outcomes of the review will inform ongoing improvement for our sector. However, we do have some concerns with the proposed timeline for responses by 4th September, especially in context of the current COVID-19 pandemic.

As President of FinPro, I wanted to respond to your letter as a way of providing some context to the difficulties this request, in particular the timing, has for the sector. By way of introduction, FinPro is the peak body servicing Local Government Finance professionals in Victoria.

The requested information is a significant piece of work for each of the 79 Councils, and as you will imagine, was unplanned for Councils during 2020/2021. Some Councils rating systems will be better prepared to provide this information than others.

As you will be aware, this is a very busy time of the year for our Finance and Revenue teams with the strict pre-existing deadlines for end of financial year audits and rates distribution. This date also coincides with the 1 September deadline for the implementation of a number of key milestones under the new Local Government Act. Coupled with the ongoing challenges of providing support to our critical front-line services during the COVID-19, we

would respectfully request an extension. This will allow our teams to better meet their community priorities whilst also providing a more informed response to your organisation.

FinPro believes given the current workload imposed on Councils, statutory deadlines and the current pandemic, an extension to the 30 October 2020 would be greatly appreciated by the sector.

We would also request that your office hold a meeting with Local Government Victoria and the Minister Local Government in relation to the current review of the Victorian Local Government Rating System. The review will have touched on a number of items that fall within the scope you have outlined. The reviews findings are with the Minister, and the sector is very much looking forward to the release of the finding in the near future.

I would be more than happy to meet with you or a representative of your organisation to discuss our concerns in further detail. Please feel free to contact us with any further questions via our executive officer, Gabrielle Gordon, at [email protected] or on 0400 114 015.

Yours sincerely,

Bradley Thomas

President, FinPro

Implementing the changes to the Accounting Standards

FinPro has developed some guidance to assist members. This information is provided following consultation with both LGV and VAGO and is included on our website.

2020/21 Council Budget Parameters and Budget Adoption Timelines

A reminder that FinPro are providing an up-to-date picture across the state of the progress of adoption of Council Budgets for 2020/21, along with measures taken within the budget to assist communities to cope with the affects of COVID-19. As Council’s adopt their budgets, please provide the updated information to gab so that she can update the survey accordingly.

Update from Vision Super

The following was distributed today (14 August 2020) to councils and is included here for your information:

Good afternoon,

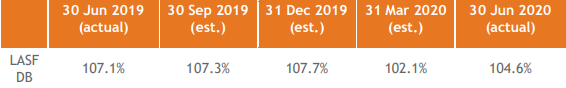

Local Authorities Superannuation Fund Defined Benefit Plan (LASF DB) – Vested Benefit Index (VBI) update (COVID-19 #8)

Since our last update dated 12 June 2020, equity markets have continued to improve following relaxation of some of the COVID-19 restrictions around the world.

The 30 June 2020 triennial actuarial investigation is currently underway and a review of the financial and demographic assumptions used in the investigation has been completed. As a result, the 30 June 2020 VBI results have been finalised as follows:

The 30 June 2020 VBI has improved compared to that at 31 March 2020. The movement in the VBI is mainly due to:

- Investment returns of 6.6% for the quarter which have increased the asset pool supporting the defined benefit liabilities of the sub-plan

- Salary increases advised to Vision Super during the quarter of 0.6%, which have increased the value of the active member benefit liabilities

- A pension CPI increase of 1.2% which was applied in June 2020, which has increased the value of the lifetime pension member liabilities, and

- An improvement in the lifetime pensioner mortality assumptions in line with the subplan’s experience. This improvement has increased the value of the lifetime pension member liabilities and, together with a change in the financial assumptions used in the triennial investigation, has resulted in a one-off decrease in the VBI of 1.6% relating to the lifetime pensions of the sub-plan.

The VBI of 104.6% as at 30 June 2020 satisfies APRA’s Superannuation Prudential Standard 160 (SPS 160).

Investment markets

During the June 2020 quarter, we have seen a reversal of some of the falls experienced by the equity markets in the quarter ended 31 March 2020.

However, a sense of unease is prevalent as the likelihood of further economic disruption from COVID-19 restrictions is increasing as the reported number of new COVID-19 cases and deaths around the world has been increasing. In addition, Australia is on high alert following the introduction of Stage 4 restrictions in Melbourne and Stage 3 restrictions for regional Victoria.

Vision Super is closely monitoring the investment markets to identify potential threats/opportunities that we may be able to avoid/take advantage of to improve the funding position of the sub-plan.

Triennial valuation

As indicated above, the 30 June 2020 actuarial review is currently in progress. This is a triennial investigation and will be a comprehensive review of the sub-plan’s position and is expected to be completed by 31 December 2020.

Until the investigation is completed, the nominated VBI shortfall threshold is 100%. In the event the VBI falls below this threshold, the Fund Actuary will consider the form of a restoration plan as part of his triennial investigation considerations.

Next update

While the equity markets are less volatile, we will monitor the sub-plan’s VBI on a quarterly basis. This means that the next update is scheduled for the VBI as at 30 September 2020. We expect to distribute this update by mid November 2020. If the equity markets increase in volatility, we will consider more regular VBI updates based on the level of volatility.

In the meantime, Vision Super is closely monitoring the investment markets to identify potential threats/opportunities that we may be able to avoid/take advantage of to improve the funding position of the sub-plan.

Action required (if any)

At this stage, no action is required by you. If you have any queries, please contact the Employer Services team on 1300 304 947 or [email protected]

Yours sincerely,

Stephen Rowe, Chief Executive Officer

Job Vacancies

FinPro is happy to place advertisements on our website for any finance related positions our members councils are advertising. Please send the following details through to Gab

The following position is currently being advertised:

- Director Corporate Services

- City of Ballarat

- https://www.salcorp-hr.com.au/wp-content/uploads/2020/08/PD-BallaratCorporate-Services-Director-6Aug2020-Final.pdf

- For further details please contact Christine Mileham on 0409 380 385 or at [email protected]

- Applications close 24 August 2020

- Revenue Coordinator

- Mitchell Shire Council

- https://careers.mitchellshire.vic.gov.au/cw/en/job/492669/revenue-coordinator

- Applications close 9am Monday 17 August 2020

- This role is responsible for the management and coordination of the revenue function including rating and valuations, debtors, voter’s role, property data and system administration, financial and resource management.

- For enquiries please contact Nicole Maxwell on 5734 6262

FinPro Executive Members

President – Bradley Thomas (Hepburn Shire Council)

Executive Officer – Gab Gordon

Vice-President: Chair Technical Committee – Tony Rocca (Maroondah City Council)

Technical Committee members:

-

- Danny Wain (Monash City Council)

- Kristy Stephens (Bass Coast Shire)

- Liz Rowland (Western Water)

- Mark Montague (Yarra City Council)

- Nathan Morsillo (Greater Bendigo City Council)

- Vishantri Perera (Yarra Ranges Shire Council)

Vice-President: Chair Professional Development committee – Binda Gokhale (Wyndham CC)

Professional Development Committee members:

-

- Belinda Johnson (Southern Grampians Shire)

- Charles Nganga (Casey City Council)

- John Brockway (Surf Coast Shire) – also leads the FinPro Mentoring Program

- Kim Jaensch (Frankston City Council) – also leads the FinPro Leadership Program

Thank-you to our 2019 Conference sponsors

We look forward to seeing you back at our next annual conference from 20 – 22 October 2021 at RACV Cape Schanck

To Contact FinPro:

Gabrielle Gordon – Executive Officer – FinPro

M: 0400 114 015

E: [email protected]

W: www.finpro.org.au

To get a copy of this article, click here.