FinPro Member Update June 2020 (Edition 4)

June 30, 2020

President’s Message

Well can’t a lot happen in a week!

COVID cases have had a spike, which resulted in the Premiers announcement on Saturday reversing some of the easing of restrictions. This week saw the swearing in of a new Local Government Minister, with the Hon. Shaun Leane now leading the sector.

A number of Councils have had their budgets adopted this week, I’m sure this will come as a relief to those Finance Units, as you can change your focus to year-end now.

School holidays start today, and I’m sure a number of you will be getting away, or at least taking some days off to relax. I highly recommend this; we have been in a crazy time for a number of months and it looks like we have a few more in front of us. Looking after yourself is the best way you can look after your family, friends and work colleagues.

We have created a survey, and we are really keen to hear from you about what FinPro can do over the coming months to assist both from a technical, but importantly from a PD side – the more fantastic ideas we have from our members then better programs we can put into place.

Have a great weekend,

Reimagining FinPro’s Professional Development for 2020

Help us establish a new look PD Program for the remainder of 2020, utilizing all the great new communication tools we are now amazing at! ZOOM, Google Meet, Microsoft Teams……

We have the opportunity to reshape how we work and we need your help – please complete the survey. Not only do you get to share your own ideas and requests, you could also win one of 2 $100 gift cards! TAKE THE SURVEY NOW

Please – help us to help you. Surveys to be completed by midnight 30 June 2020.

Membership News

We welcome Susanne Meier as a new member. Susanne has going the team at the City of Greater Bendigo as Management Accountant – welcome!

We farewell Seona Breen, Management Accountant at Mitchell Shire.

If you have any news to share with the FinPro membership please forward this to Gab.

FinPro Technical Committee News / Updates

General Information

The LGV website provides a host of information: LGV – COVID19 Information

The FinPro Website provides a host of information: FinPro Resource Library

Information available here includes:

- Previous copies of the FinPro Member Updates

- Implementation of the Local Government Act

- Accounting Standards Guidance

- Model Budget 2020/2021 and Model Financial Statements 2019/20

- Samples of council policies

Local Government Act 2020 Implementation – Update

Some of our members have asked for assistance in locating information about the timing of Royal Assent and operating across the two acts:

This link has the transitional arrangements which includes the dates of when each stage receives proclamation. The 1989 Act remains in place until the relevant section is proclaimed. It’s important to also know that Section 163 which is about Rates, is not repealed and remains in force.

Questions have also been asked about locating a ‘Phasing ‘checklist’ and the implementation of the relevant sections would be great.

This timeline is clearly outlined on the above link and LGV have also listed the dates of when each item is required.

For reference – this link is: https://www.localgovernment.vic.gov.au/our-programs/localgovernment-act-2020/council-implementation-timeline

Update from LGV – LGPRF Guidance

LGV issued some guidance on Tuesday 23 June 2020 around the COVID-19 impacts on LGPRF indicators. This information was placed on the LGV website –

The link is:

https://www.localgovernment.vic.gov.au/__data/assets/pdf_file/0030/469047/BPGPerformance-Reporting-Framework-Indicator-Workbook-2019-20-COVID-19-Supplement.pdf

Update from LGV – recent regional workshops

Local Government Victoria recently ran four virtual regional workshops to assist council finance staff in applying the Model Budget and Model Accounts templates. These templates guide the format and presentation of the financial statements in council annual budgets and annual reports. They are available here.

The sessions also covered a range of topical issues including the implementation of the Local Government Act 2020, the impact of new Australian Accounting Standards on the 2019-20 financial year, and key financial reporting impacts for councils to consider as a result of the coronavirus (COVID-19) pandemic.

A recording of this webinar is available upon email request to Sadiq Hussaini – [email protected]

Update from VAGO

This week VAGO issued their June Update to councils. In case you missed this distribution, the topics covered were:

- Changes / updates in response to COVID-19 (see also more detail below)

- Asset Revaluations

- Valuation Indices

- Related parties

- Wage inflation and discount rates as at 31 May 20 for the measurement of employee entitlement liabilities

- Bank confirmation process

- Shell accounts (financial report and performance statement), and

- VAGO performance audit and other integrity bodies update

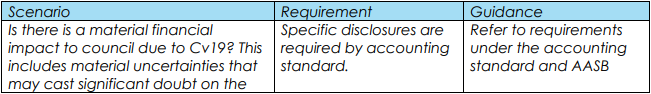

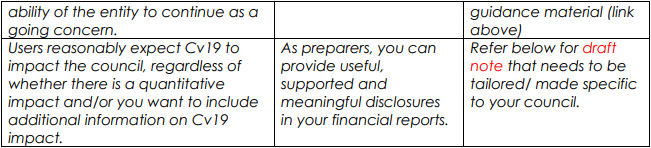

Following up from a number of queries FinPro has received from members in regards to disclosure to be made in this year’s financial reports around COVID-19, VAGO issued the following information:

I understand that some councils are planning to disclose impact of COVID 19 crisis (‘Cv19’) in their financial report. Below are some high-level audit expectations if your council is including a disclosure on Cv19 impact and a draft note with some suggested wordings for your reference.

Refer AASB guidance material on impact of Cv19 on financial reporting, noting that the impact of Cv19 on each council is expected to be varied and disclosures need to be tailored/ made specific to your council.

Requirement to disclose Cv19 impact in 2019-20 financial report:

Note xx Impact of COVID 19 crisis on council XX operations and 2019-20 financial report:

On 30 January 2020, COVID 19 was declared as a global pandemic by world health organisation. Since then, various measures are taken by all three levels of Government in Australia to reduce the spread of COVID-19. This crisis and measures taken to mitigate it has impacted council XX operations in the following areas for the financial year ended 30 June 2020:

- In response to significant decrease in demand / government directive amidst the COVID-19 outbreak, the leisure centre facilities / libraries/ community centres were closed. These closures resulted in a decrease in the council user fee revenue by $ x million/thousand and also decreased associated expenses by $ x million/thousand.

- Council XX paused all commercial rent agreements from xx XXXX 2020. This resulted in decrease in rent revenue of $ x million/thousand.

- Council activated its hardship policy in response to this crisis on xx XXXX 2020. This resulted in an increase in expenses of $ x million/thousand.

- Financial impact till date from deferral of rates revenue/ interest free period is $ x million/thousand. This has also resulted in the debtor balance as at 30 June 2020 to increase by $ x million/thousand compared to last year.

- Add any other description specific to how council’s financial position and performance has or is likely to be affected….

- …

Additional comments:

- Impact assessment of Cv19 to include material uncertainties that may cast significant doubt on the ability to continue as a going concern. This may be relevant for council associated entities (leisure centres / markets etc,) that prepare separate financial reports.

- If you decide to include the impact of Cv19 as a disclosure in your 2019-20 financial report, auditors will be looking for evidence to audit the disclosure note.

- Note – Early identification and discussion with your auditor on Cv19 related impacts to your financial report / performance statement will help to reduce pressure during the year-end phase.

What happens if a significant event (e.g. second wave of Cv19 outbreak) happens between 30 June 2020 and the date when council authorizes the financial statements?

- In such an event, management must determine how the developments subsequent to 30 June 2020 should be reflected in the entity’s financial statements. AASB 110 Events after the Reporting Period provides guidance on this.

What about disclosures in performance statement around Cv19 impact?

- From my discussions with the performance statement team at LGV, I understand that specific guidance on presentation / disclosures of indicators impacted by Cv19 will be made available to councils.

If you have any queries or would like to receive a copy of this update please contact Sanchu Chummar, Acting Sector Director, Local Government at VAGO – [email protected] or 0472 838 905

Update from the ESC – Compliance with the rate cap in 2020-21 Update

The following information was sent out by the ESC this week:

As the end of financial year approaches, we would like to provide councils with an update on compliance with the rate cap in 2020-21.

Compliance submission is now due 30 October

In response to feedback from the sector, the commission has decided to extend the deadline for the annual compliance submission from 30 September to Friday 30 October. However, councils are welcome to submit their compliance information any time before the due date.

Valuations still need to reflect 30 June and 1 July

In light of the extension to the statutory reporting deadlines, we would like to emphasise that the dates on which compliance is tested (30 June and 1 July) have not changed. Please ensure that the rating system reports show the correct information.

As a reminder, rating system reports must include:

- Total valuations as at 30 June 2020 and 1 July 2020 for each differential category

- Number of rateable properties as at 30 June 2020 and 1 July 2020 for each differential category

- Number of municipal charge properties as at 30 June 2020 and 1 July 2020 (if this does not appear on your council’s rating system reports, other supporting documentation is acceptable)

For councils that cannot provide rating system reports, the numbers must be reconciled to the Valuer General’s report of general valuation.

CEO certification and signed rating system reports

Please ensure that both the CEO certification sheet and valuation reports are signed by the CEO. Any changes made to the template after it is submitted will require a new certification.

Relevant links

The guidance and annual information template can be found on our website. The direct links to the documents are below:

- Compliance Monitoring and Reporting: Guidance for Councils 2020-21

- Annual compliance information template 2020-21

The annual compliance information template has been updated to reflect the commission’s style guide. These changes are cosmetic only. There have been no changes to the information the template collects or to the commission’s approach to compliance. If you have any issues or queries about compliance with the rate cap in 2020-21, please contact us at [email protected].

Local Government Team, Price monitoring and regulation, ESC

Training opportunities

Community Engagement for Rural Councils Rural Councils Victoria is delivering training to build the capacity of rural Councils to conduct

community engagement and enhance their practice. This is particularly important at this time as Community Engagement for governance, finance and policy is a key component of the Local Government Act 2020.

There will be two types of training offered:

- General community engagement training, and

- Practice-area / subject matter focused training

5 Free online community-training sessions are available between 29 June and 13 July.

For further details and to register please refer to the following information

Job Vacancies

FinPro is happy to place advertisements on our website for any finance related positions our members councils are advertising. Please send the following details through to Gab

The following position is currently being advertised:

- Manager Financial and Corporate Planning

- Frankston City Council

- More Details: https://www.seek.com.au/job/50095754

- Closes: Wednesday 1 July 2020

FinPro Executive Members

President – Bradley Thomas (Hepburn Shire Council)

Executive Officer – Gab Gordon

Vice-President: Chair Technical Committee – Tony Rocca (Maroondah City Council)

Technical Committee members:

-

- Danny Wain (Monash City Council)

- Kristy Stephens (Bass Coast Shire)

- Liz Rowland (Moreland City Council)

- Mark Montague (Yarra City Council)

- Nathan Morsillo (Greater Bendigo City Council)

- Vishantri Perera (Yarra Ranges Shire Council)

Vice-President: Chair Professional Development committee – Binda Gokhale (Wyndham CC)

Professional Development Committee members:

-

- Belinda Johnson (Southern Grampians Shire)

- Charles Nganga (Casey City Council)

- John Brockway (Surf Coast Shire) – also leads the FinPro Mentoring Program

- Kim Jaensch (Frankston City Council) – also leads the FinPro Leadership Program

Thank-you to our 2019 Conference sponsors

To Contact FinPro:

Gabrielle Gordon – Executive Officer – FinPro

M: 0400 114 015

E: [email protected]

W: www.finpro.org.au

To get a copy of this article, click here.